Generative AI for insurance data extraction & analysis

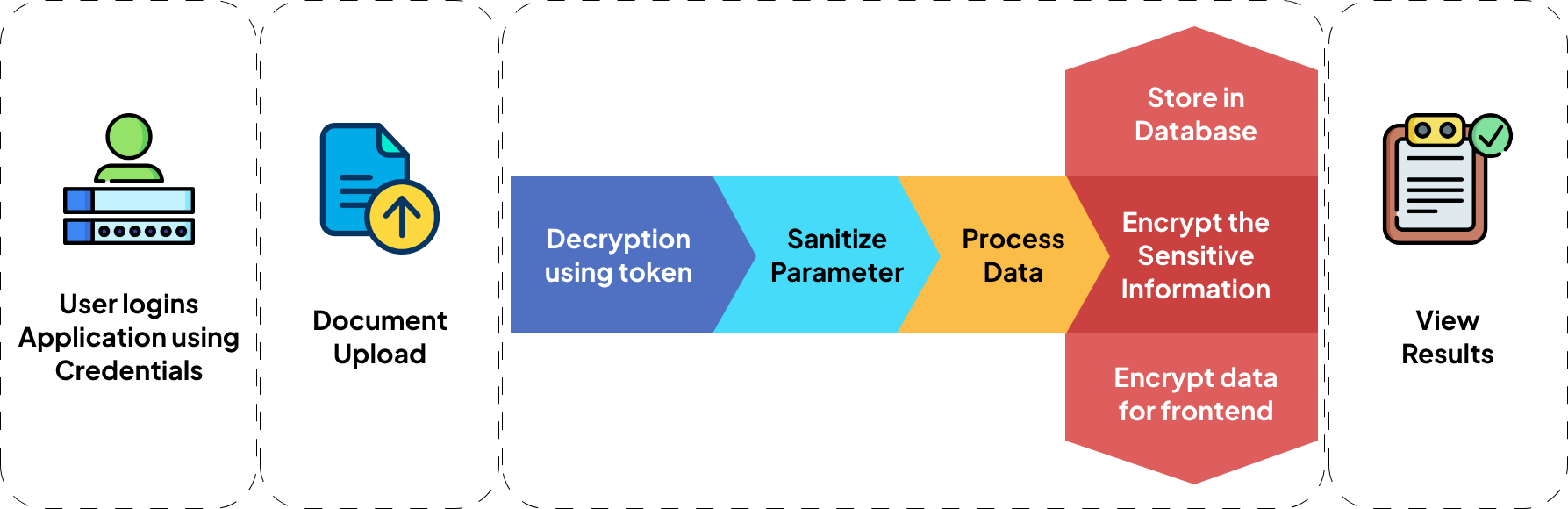

Architecture diagram

Problem statement

Complex Property Insurance Documents: Addressing the challenge of deciphering intricate property insurance documents, which often contain dense legal language and technical terminology.

Efficient Data Extraction and Comparison:Streamlining the extraction, classification, and summarization of key insurance policy data to facilitate quick and accurate comparisons between contracts and offers.

Language Barriers: Overcoming language barriers by processing documents written in non-English languages, ensuring accessibility for users.

Data Privacy Compliance: Ensuring compliance with data privacy regulations, such as GDPR, by implementing encryption, access controls, and anonymization techniques to safeguard sensitive customer data.

User-Friendly Policy Analysis: Providing a user-friendly platform for policy analysis, enabling users to easily navigate and understand complex insurance terms and conditions.

Solution Overview

OptiSol worked with a startup company in building a Minimal Viable Product (MVP) for efficiently processing complex Property Insurance documents in Switzerland using Natural Language Processing (NLP) and GPT-based models.

The solution will extract, classify, and summarize key insurance policy data, including coverage, deductibles, exclusions, and limits, from uploaded PDF documents in the non-english languages like German, Arabic etc.

To protect sensitive customer data, the solution will incorporate encryption for data at rest and in transit.

AWS cloud hosting with robust security measures, access control, and anonymization techniques will ensure GDPR compliance.

In addition to document processing, the solution will offer advanced features such as comparing insurance contracts and offers, anonymizing sensitive data, and implementing a question-answering system for precise information retrieval.

Business impact

Efficiency and Cost Reduction: The solution optimizes document processing, leading to significant time and cost savings for insurance companies and policyholders alike.

Informed Decision-Making: By offering accurate and comprehensive data extraction and comparison capabilities, the solution empowers users to make informed decisions regarding insurance policies, ultimately reducing the risk of financial losses.

Revenue Generation: The platform's advanced features attract users and create a new revenue channel for the business, enhancing its financial performance and growth potential.

Competitive Edge: By providing advanced functionalities such as document comparison, data anonymization, and question-answering systems, the solution distinguishes itself from competitors and strengthens the business's position in the insurance industry.

Customer Satisfaction and Retention: The user-friendly interface and comprehensive features enhance customer satisfaction, leading to increased loyalty and retention rates among users of the platform.